| « Christian Influence | Amending for Education Credits » |

ACA: 2014 Observations and Updates

Introduction

Our current health care law has many names depending on the context. While healthcare reform was the generic reference, the official name is the Patient Protection and Affordable Care Act or PPACA, but people know it as ObamaCare when referring to it in a political context. Much of the analytical references use ACA and that is what I will use here.

Discussion of the Affordable Care Act calls for a different format from previous O&U posts since ACA is essentially a new filing requirement. While there has been a considerable amount of change (updates) during the evolution of the law, understanding what the current requirements is the most important thing. That is not to say the law is finalized. The reporting gap due to delay of the employer mandate and the definition of marketplace for the premium tax credit are a couple of issues that still may need to be finalized.

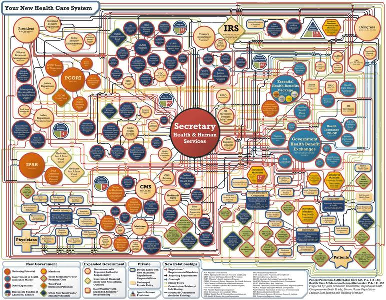

An entry in the AICPA blog described the ACA as a maze of rules and regulations. A look at the flowchart best illustrates the complexity of the law, and the regulations make it even more daunting.

I've only looked at a few IRS parts of the law and for each aspect, I’ve personally considered the concepts pretty straightforward; but there's just so much of it. This will reference only some of those basic concepts.

From a tax preparer’s perspective for the 1014 tax year, I offer this simple summary for individual returns. In practice, you would do well to have reference material to evaluate individual cases and the exceptions.

- Taxpayers will need to report whether or not they (and family members) were insured

- If not, they need to determine whether or not they are exempt.

- If insured, they need to determine if they qualify (or qualified) for the premium tax credit or not, and how much.

- If not insured, they need to determine whether they owe a penalty or not, and how much.

It is the taxpayer’s responsibility to comply with the health care law, but it is ultimately the tax preparer that will be doing most of the work. The taxpayer’s biggest task is providing or keeping the forms necessary to file and support their return, and that may not be easy. There are forms that should support claim of insurance, but employers are not required to prepare them until the 2015 tax year. Even then, that requirement may only be limited to large employers.

http://blog.aicpa.org/2014/08/aca-a-maze-of-rules-and-reporting-requirements.html

The law

The IRS code covering ACA is spread across multiple sections. The primary components of ACA reporting are found in Section 5000A (shared responsibility and exemptions) and Section 36B (premium assistance tax credit. Numerous regulations have been released that cover these sections. The web page http://www.irs.gov/uac/Affordable-Care-Act-Tax-Provisions provides a useful list of components of the ACA and recent updates, although the very latest regulations (November 24, 2014) have not been included at this time.

Other than reporting, taxes, and credits, there are a number of things in the law that clients should know concerning coverage. For one thing, the law now restricts insurance companies on what they can limit. For example, insurers can no longer refuse to issue policies when individuals have pre-existing conditions. Employers can only wait 90 days before covering employees. The law also categorizes health plans based on the average percentage the plan pays of the overall cost of providing essential health benefits to members. The categories or levels are bronze, silver, gold, and platinum and range from 60% - 90% coverage. Actual percentages may vary and take into consideration co-pays, deductibles, and maximum out of pocket costs. A separate catastrophic plan is available for individuals under 30 years old with a hardship exemption which covers less than 60%. The latter does not qualify for the tax credit, however.

Regulations also exist that determine when an employer-sponsored health plan provides minimum value and thus MEC. The latest concern is whether a plan that fails to substantially cover in-patient hospitalization or physician services provides minimum value. Notice 2014-69 released on November 4, takes the view that insurance that fails to provide in-patient hospitalization fails to meet the minimum requirements. At issue is the manner in which minimum insurance is calculated via the MV Calculator and the extent to which the calculation determines minimum coverage. The MV calculation determines what metal categories health plans fall into based on the percentage of coverage. Pending final regulations, employees will not be required to treat such policies as minimum coverage, and thus leaving them options to seek other coverage, and the premium tax credit.

Additional requirements apply to larger employers including reporting requirements and a tax that applies when employers do not provide their employees minimum coverage. The effective date for these employer mandates, according to Notice 2013-45, has been moved to tax year 2015 and will be phased in. In some cases there may not be a penalty if the employer waits until 2016 to begin reporting 2015.

In addition to the actual healthcare regulations there are additional taxes on investment income of the wealthy and an additional amount of Medicare tax that applies to individuals at higher income brackets. A special concern with these taxes is the need to track income during the year and make appropriate estimated tax payments or face penalties. Adequate planning can also help taxpayers avoid or minimize these taxes.

These are just the basics, elements that may affect most people’s tax return. There are many other regulations that could affect specific individuals or entities. For example, it hasn’t been discussed much, but there is also a tax on health insurance providers, for example.

https://www.healthcare.gov/choose-a-plan/plans-categories/

The tax forms

Although you can’t familiarize yourself with all of the actual 2014 tax forms (1095 series, 8962, and 8965) just yet, you should know what they are. Forms 8962 (Premium Tax Credit) and 8965 (Health Care Exemptions) are final, but not their instructions, nor the 1040.

The latest draft version of the 1040 shows these extra lines

- Line 46: Calculation of premium tax credit repayment

- Line 61: Individual responsibility

- Line 69: Premium tax credit

Note: Actual line numbers may be different when the final form is released. In another article, the individual responsibility payment was on line 62. The same lines have been added to 1040A with different line numbers. Only the line for individual responsibility is on the 1040EZ draft and 2014 1040EZ instructions have not been released at all. You cannot use the EZ if you claim or have received any amount of the premium tax credit.

If the taxpayer has full year coverage and no premium tax credit, only a checkbox on 1040 is required. Otherwise, taxpayers may need to file 8965 to report exemptions. Form 8962 is the form to be used to claim the premium tax credit or calculate credit repayments.

It’s worth noting that the line for individual responsibility has two purposes. The checkbox is used to indicate full year coverage. If you don’t have full year coverage and don’t qualify for an exemption, the payment is calculated and entered here. If you have an exemption, you don’t have to do anything with this line, but you do have to complete another form.

This is where it can get confusing. If you have an exemption, you will need to complete Form 8965 to show the type of exemption. If you are required to make a payment, the draft instructions say to see the instructions for Form 8965 (Health Coverage Exemptions). The worksheets in 8965 are used to calculate the payment.

When released, taxpayers may need to provide a Form 1095 to show who in the household has coverage. This form comes in three flavors. The 1095-A will come from the marketplace, 1095-B will come from insurers, and 1095-C will come from employers with a group plan. Not only will these forms show who has coverage, but some may also show what the government paid in subsidies. Only the marketplace is obligated to provide this form for 2014.

The delay in requiring employers to comply with ACA has lead to a reporting gap since the individual mandate was not delayed. Individuals must have insurance, and will need to have proof of insurance, although nobody (except the marketplace) is required to provide that proof. Individuals will need to maintain other records showing their compliance. While this may be an inconvenience, many other tax credits and deductions also require taxpayers to keep receipts and other proofs. This also affects the IRS since they will not have information to determine if you do have the required coverage for 2014.

http://blog.aicpa.org/2014/08/aca-a-maze-of-rules-and-reporting-requirements.html

http://www.accountingtoday.com/ato_issues/28_11/The-ACA-What-to-tell-your-clients-72577-1.html

Healthcare Coverage Issues

Individual Mandate Penalty

Probably the most controversial areas of the ACA are the individual mandate and associated penalties. ACA requires each individual to have qualifying insurance, an exemption, or pay an individual responsibility payment. The amount of that payment is phased in over three years.

It’s easy for the casual observer to overlook the fact that the penalty is the greater of the annual payment or a percentage of income. The limit is the price of an actual policy for that year, specifically a plan that provides a bronze level of coverage. Given the average income level of an individual making 35,000 above their filing threshold, the actual penalty is considerably more than the base annual payment amount.

Individual

|

Year |

Base |

Percentage |

Average AGI |

Penalty |

Limit |

|

2014 |

95 |

1% |

35,000 |

350 |

2,448 |

|

2015 |

325 |

2% |

35,000 |

700 |

? |

|

2016 |

695 |

2.5% |

35,000 |

875 |

? |

The amount for taxpayers with more than one person in the household will be calculated based on the number of adults and children not covered.

The penalty for failure to maintain coverage can be deducted from future overpayments and unpaid penalties will accrue interest, however, the law does not allow for criminal prosecution for failing to pay the penalty nor is the IRS authorized to use liens and levies to get payment.

Minimum Essential Coverage

Minimum Essential Coverage (MEC) is the taxpayer’s term for describing health coverage that meets the ACA requirements. MEC can be acquired through an employer-sponsored plan for employees and retires, COBRA coverage, individual health coverage purchased from an insurance company, the marketplace, provided by student health plan (within limits), or government plans such as Medicare, Medicaid, CHIP, and some plans for veterans. Coverage that provides limited benefits does not meet the MEC requirements. Some limited benefit plans may be considered MEC for the 2013 tax year.

Coverage Exemptions

There are two kinds of exemptions; household exemptions and individual exemptions.

Household exemptions

Household exemptions are based on household or gross income for the tax year, so it’s not necessary to figure exemptions on a monthly basis. If a household exemption applies, all members of the household are exempt.

If you don't have to file a tax return, your tax household is exempt from the shared responsibility payment and you do not need to do anything else to claim the coverage exemption. But, if you do file a return for refunds or credits you will need to complete section II of Form 8965.

Individual exemptions

There is a large number of individual exemptions that may apply for one or more months of the year. Some are available through a Marketplace certificate while others must be claimed on a return. These are listed in a table in the 8965 instructions. A few of them are

- Unaffordable coverage exemption based on a percentage of income.

- Health care sharing ministry exemption.

- Qualified American Indian exemption.

- Short-term lapse exemption, up to three months.

- Marketplace related delay exemptions.

- Hardship exemptions

Some exemptions exist that have not been included in the 8965 instructions list. The latest list of exemptions that do not require a Marketplace certificate were published in Notice 2014-76, and include, for example, a hardship exemption if the individual enrolled outside the Marketplace in minimum essential coverage for 2014 that is effective on or before May 1, 2014. One estimate is that 90% of the uninsured qualify for an exemption.

Final regulations concerning minimum essential coverage in Section 5000A and the shared responsibility payment were recently released in TD 9705.

http://www.irs.gov/uac/ACA-Individual-Shared-Responsibility-Provision-Minimum-Essential-Coverage

Premium Tax Credit

An aspect of the ACA that spans those who are required to have coverage and those who may be exempt is the Premium Assistance Tax Credit (PTC). The PTC is available for a wide range of low to middle income taxpayers, based on modified adjusted gross income (MAGI). This MAGI includes all social security, Section 911 income, and all interest income. The income level qualifying for PTC range between 100% and 400% of the relevant federal poverty level (FPL) and, according to some estimates, would encompass 2/3rds of all households.

What may not be clear to many people is that the PTC is only available for coverage purchased though the Marketplace, referred to as a qualifying health plan (QHP). Even that can be confusing, since final court rulings are outstanding that clarify if the federal marketplace, or only state marketplaces are eligible for the PTC. Also, the credit is only available if the taxpayer doesn’t already have insurance. One aspect of the PTC that may come as a surprise is that taxpayers below the poverty level do not qualify. That is due to the fact that they may be eligible for Medicaid, although there are other qualifications.

The credit amount is based on a percentage of MAGI and ranges from 2% to 9.5% where the amount limits the amount of the premium that the taxpayer must pay for the benchmark plan. The benchmark plan is the second lowest Silver plan (SLCSP) available on the exchange. Taxpayers wanting a higher quality plan will have to pay the remaining costs or they can choose a minimum bronze plan and lower their costs. If the selected plan includes extra benefits (except pediatric dental coverage), the cost of those benefits may be excluded by Section 36B(b)(3)(d) in determining the amount of the credit.

The PTC is a refundable credit, and taxpayers may elect to use an advance credit. Form 8962 is used to report the premium tax credit and repayments. Advance credits are applied directly to the premium amount based on their income when they sign up. If the income is significantly different at the end of the year, the taxpayer may receive an additional credit or have to repay amounts taken as advance credits. However, Section 36B(f)(2)(B)(i) limits the amount of repayment based on amounts in a table published there, adjusted for cost of living. This limit is entered on line 28 of Form 8962 based on percentage of FPL.

The calculation of the PTC may be the most time-consuming aspects of the ACA for individuals, partly because calculations are required on a monthly basis if coverage was less than a full year, and partly because of necessary calculations for exceptions. This alone could convince tax return do-it-yourselfers to seek the assistance of tax professionals.

Those few taxpayers that have traditionally benefited from itemized deductions will also have to remember that they can only deduct what they paid, essentially net of the credit. Rev. Proc. 2014-41 covers the interaction between 162(l) and 36B.

Additional regulations have also been released that designate victims of domestic violence or abandonment as qualifying taxpayers by allowing them to be treated as unmarried. The PTC is not available to those married filing separately.

https://www.kitces.com/blog/understanding-the-new-premium-assistance-tax-credit-under-obamacare/

Employer Issues

Individual tax issues related to ACA are complex, but Employer issues can be just as complex and must be blended with individual requirements to get a full picture of the requirements. Similar to the individual mandate, employers may be subject to penalties, may have exemptions, and may be qualified for tax credits for providing health coverage.

Additionally, regulations exist and are sure to be expanded that define minimum value, qualifying plans and reporting requirements. How employers fair may also depend on how such things as Flexible Spending Accounts (FSA), Health Reimbursement Accounts (HRA), and Health Savings Accounts (HSA) are integrated with other health benefits.

Since the enforcement of much of the employer mandate has been delayed, I will reserve detailed discussion of employer issues for a later date. One issue that has not been delayed is the Small Business Credit.

Small Business Health Care Tax Credit

While the Small Business Credit has been around since 2010, there are significant changes in the credit for 2014 and later. There are three primary requirements. The credit is available to employers with less than 25 full-time employees (FTE), with average salary less than $50,000, and insurance must be purchased through a Small Business Health Options Program (SHOP) marketplace beginning in 2014. Businesses must cover at least 50% of the cost. Some exceptions may apply. As always, there are several nuances that you may need to research. Employers may also be eligible for credits for prior years, and can file amended returns under the standard statue of limitations (3 years from due date, or 2 years from date paid).

The credit could be worth up to 50% of premiums paid for the smaller employers, and can be carried forward or back to other tax years. Also beginning in 2014, employers are limited to claiming the credit to two consecutive years. Tax-exempt employers (501(c) only) could also qualify for the credit and within limits, be qualified for a refundable credit, which may be adjusted by a sequester reduction.

The credit is calculated on Form 8941, and covers not only MEC amounts, but also limited benefit plans that do not meet minimum value, such as dental, long-term care, and home health. Although the credit is available for reimbursements, according to the 2013 Form 8941 instructions, it does not cover FSA, HSA, and HRA plans. These plans have been discussed in regulations and may come into play when determining whether employer coverage meets minimum value in 2015.

http://www.accountingtoday.com/ato_issues/28_10/tax-strategies-aca-72211-1.html

http://www.irs.gov/pub/irs-utl/small_business_health_care_tax_credit_scenarios.pdf

http://www.journalofaccountancy.com/News/20149468.htm

Other Tax Issues

NIIT, Additional Medicare taxes

While health care coverage and penalties may be the concern of many lower income taxpayers, the investment income and additional Medicare taxes may be a concern for many middle and upper income taxpayers. These taxes are part of what funds the enforcement of the healthcare mandate. There’s not much to do about shared responsibility payments other than to decide if the costs are worth it, but there are several things that upper income earners can do to minimize and eliminate the added investment and Medicare taxes. More about that as time permits.

Conclusion

Following the development of the new health care law and IRS regulations has been very educational for me, and sorting through dozens of articles on the subject at different times has been a challenge. The regulations will very likely change again after this post and there is a slight possibility that I've omitted or mistated something, so your comments, questions, and corrections are welcome.