| « Education Credits: Tax-Aide Has It Wrong | Excelling With Access » |

Education Credits in TaxWise

Ed. Note: This article has been modified since first published. Example 2 now considers scholarships included in income to be limited to the amount of elective scholarships. 05/06/2015

Over the past year I've written long articles and prepared materials for an Education Credit Toolkit. Some of it may be intimidating since it is so detailed and gets into the tax code and regulations. This is a brief set of instructions for reporting education credits in TaxWise to assist in preparing most returns with AOTC. The process is pretty simple and will be very similar in other tax packages. The three steps include a 1098T Analysis and Inquiry, Preliminary Calculations, and Including Elective Scholarships. The first two steps have probably already been a part of your work flow.

1098T Analysis and Inquiry

First do a 1098T analysis and inquiry. Look at the form and ask appropriate questions. When someone comes in with a 1098T the first thing you should do is look at the half-time box. If that is not checked, then that student doesn't qualify for AOTC. But they may qualify for the Lifetime Learning Credit.

Next, see how the expenses are reported on the form. They can report amounts received on amounts billed or amounts actually paid. If box 3 or box 7 is checked, taxpayer will need to provide additional information. If box 7 is checked the amounts shown may include amounts not paid. If amounts billed for first three months of the next year were actually paid, then the taxpayer can include them in qualifying expenses. Generally scholarships and grants are not paid in advance. The amounts reported may not include amounts paid that were billed in the prior year.

In all cases, verify the amounts paid, and from what sources. Ask what expenses were paid. Normally all expenses would have been paid if they do not owe the school. Amounts paid by check or through school loans are considered amounts paid. Although I prefer to get account information from school, you can rely on the information provided by the taxpayer. If you don't have account information from the school or a 1098T you should not file for education credits. Claiming credits without proof has been a common method of tax fraud.

Then ask about books and computer expenses that may not be on the 1098T. If they are required expenses they can include them as qualifying expenses paid.

(Optional) You may ask about use of Coverdell ESA, or IRA money used to pay expenses. This money is tax-free and can cover room and board. These are rarely used. Normally you would subtract room and board from this amount (Don't add to qualifying expenses) and subtract the remaining from QE or include in income. Penalty exception applies for IRA distribution. There are many other forms of education benefits.

In order to explain the calculations, consider the following example..

Example 1:

Student has 7000 in expenses (billed) and scholarships of 5250 (all from a Pell grant). Box 7 is not checked. He purchased 720 in books from an on-line retailer.

Preliminary Calculations

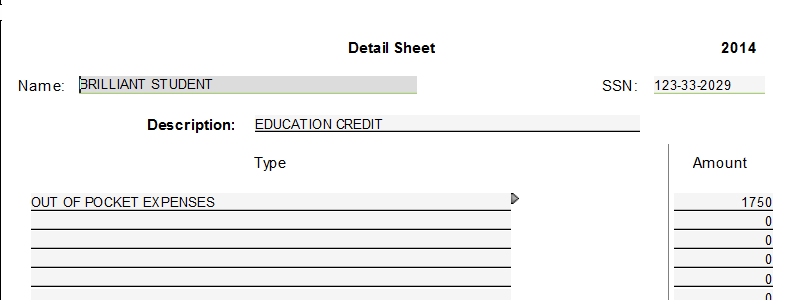

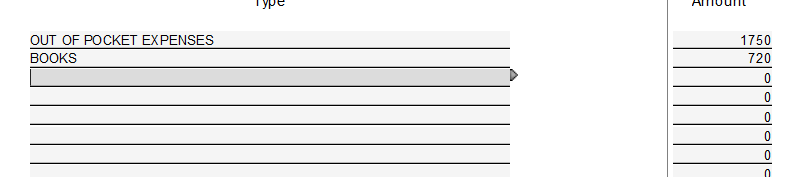

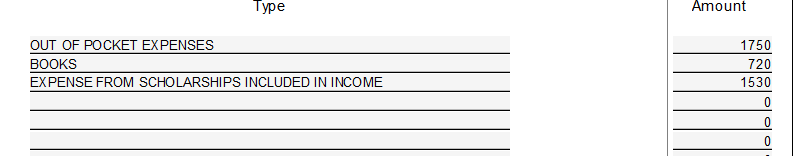

Total and enter the information in 8863 including the amount of qualifying expenses. If none of the expenses are paid with scholarships and grants, you can include all expenses on 8863 and you should be finished with preliminaries. If scholarships are reported, you will need to offset expenses with those scholarships. Subtract scholarships from expenses to get initial Qualifying Expenses and enter that amount on 8863. If several items will be included in expenses, you will want to use a scratchpad to identify each one. In this example, 7,000 - 5,250 = 1,750 expenses would be entered.

ScratchPad

Form 8863

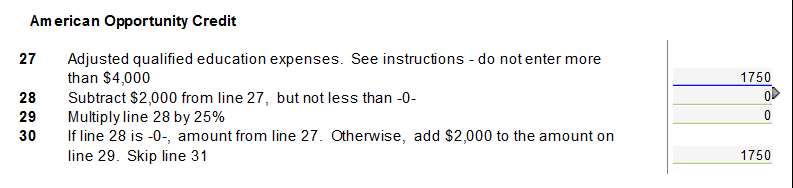

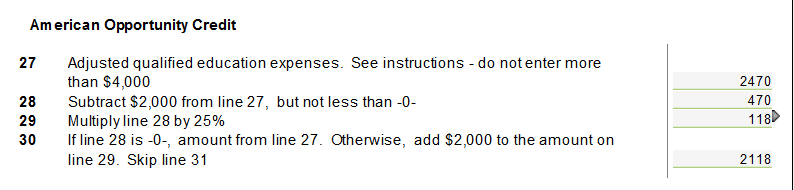

Books (AOTC only)

If books were not purchased from the institution, add that to qualifying expenses at this point. The initial expenses plus the 720 for books brings the total to 2,470.

Experienced taxpayers probably know all of the above. The following is what you can change to increase qualifying expenses.

Including Elective scholarships

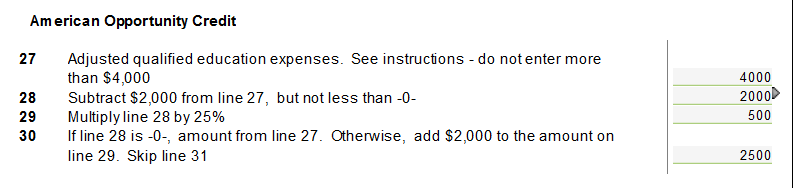

Ask taxpayer about the nature of the scholarships. If the scholarships include Pell grants, add enough Pell grant money to the expenses in order to bring the total to 4,000. In this case, 4,000 minus the initial 2,470 equals 1,530. We enter that amount first to expenses.

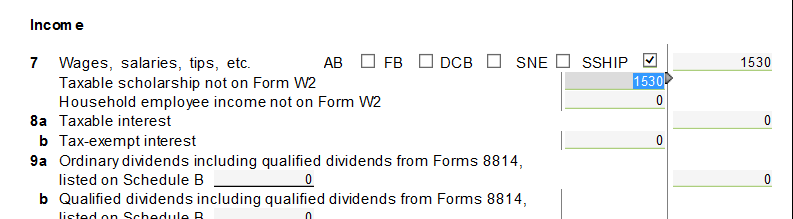

Then you need to add the same amount to Line 7 scholarships. You will need to use the second line on the form and link to a scratch pad. This amount must be identified as scholarships. If it is just included in the Line 7 total, then it would incorrectly be added to earned income for EITC.

Form 1040:

This concludes the calculation of the education credit for this example.

Excess scholarships

Now let's assume that the student has scholarships in excess of expenses.The process is the same except that you initially include the excess scholarships in income instead of including expenses on 8863. The following example illustrates the process in this case.

Example 2:

Student has 7,000 in expenses (billed), and 9,000 in scholarships and grants (including a 5,250 Pell grant). She also purchased 720 in books from an on-line retailer.

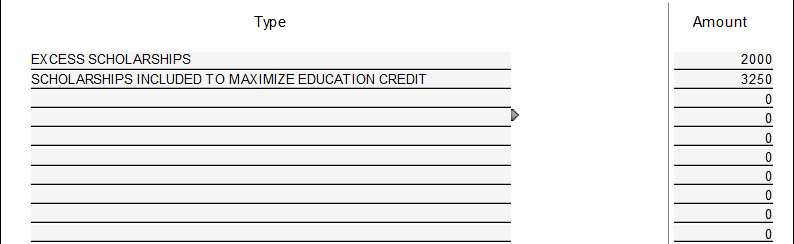

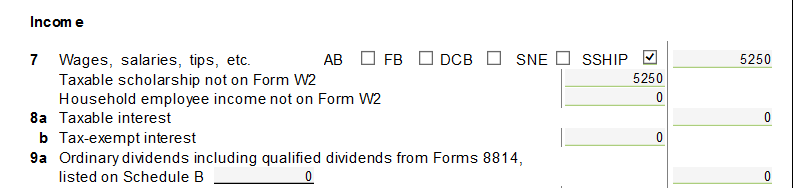

If scholarships are greater than expenses, subtract the expenses from scholarships to get the amount of taxable scholarships. If we assume the student had 9,000 in scholarships and 7,000 in expenses, she would include 2,000 (9,000 - 7,000) in taxable scholarship income.

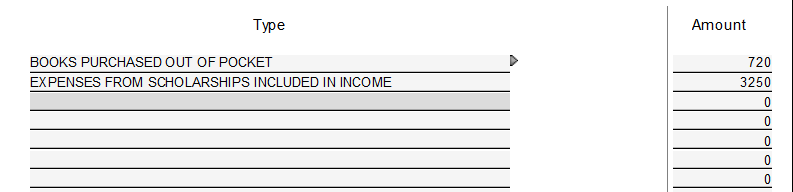

Next, she would include any expenses not included on the 1098T, such as the 720 in books, as qualifying expenses on the 8863.

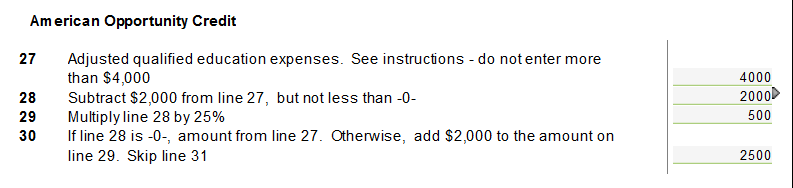

Finally, she would calculate and include enough of the Pell grant in expenses (4,000 - 720 = 3280) to maximize AOTC expenses, AND include the same amount in scholarship income.

However, in this example another issue needs to be addressed. Since there was an excess amount of scholarships, the amount of elective scholarships must be reduced by that amount. The maximizing amount for the credit is $3,280, but the elective amount of the Pell grant is now 5250 - 2000 = 3250 so that limits the amount to add to qualifying expenses and taxable scholarships. This amount $3,250 is now added to both qualifying expenses and taxable scholarships. If using the AOTC worksheet covered elsewhere this issue is resolved automatically. The AOTC worksheet could also be completed and used as the primary input source.

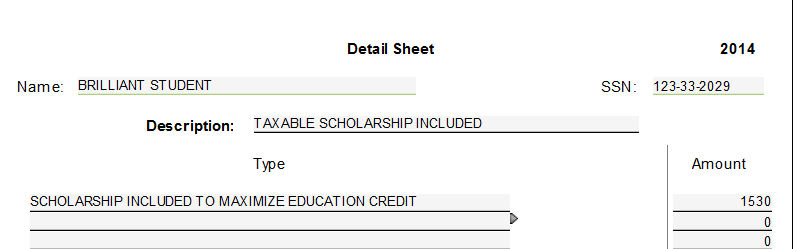

The following screenshots show the completed forms for this example.

Scholarship Income Scratch Pad:

These examples illustrate the treatment of Pell grants. Other scholarships might be able to be treated the same way, but it will require knowing the terms of the scholarship. For more information on that see my previous articles and toolkit.

Note: If scholarships are reported on W-2, report as W-2 earnings. Don't make adjustment to QE or taxable scholarships.

Lifetime Learning Credit

Pell grants can be treated the same way in calculating the LLC. The most notable exception is that books must have been purchased from the institution and would already be included on the 1098T. The LLC would apply, for example, if the student has already received his 4-year degree before the beginning of the tax year, or was not attending at least half-time. The LLC is not refundable.